Graduated Payment Mortgage

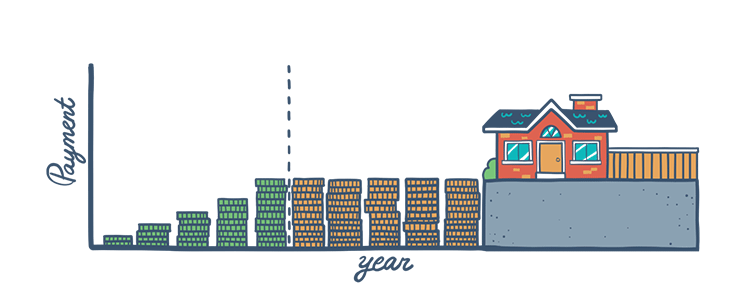

The FHA has a particular loan available for low- to moderate-income homebuyers who expect their incomes to increase in upcoming years. The Graduated Payment Mortgage (GPM), also known as HUD's Section 245(a), is a kind of fixed-rate mortgage that starts with lower monthly payments that gradually increase based on a predefined schedule. Typically, the GPM payments increase between 7-12% annually from the initial amount until the full monthly payment amount is reached.

How Does a GPM Work?

It's important to understand how the monthly mortgage payments for a graduated payment mortgage work differently than that of a regular fixed-rate loan. A graduated payment mortgage starts with smaller minimum payments, with the payment amount increasing gradually over time. The low introductory interest rates make it so more borrowers—who might not otherwise qualify—can afford the low initial payments and be eligible for the loan. Different payment plans are available with varying lengths and rate of payment increases, and some include a higher down payment as well.

The FHA offers five different GPM plans to suit borrowers' needs.

- Plan I:

Monthly mortgage payments increase 2.5% each year for 5 years - Plan II:

Monthly mortgage payments increase 5% each year for 5 years - Plan III:

Monthly mortgage payments increase 7.5% each year for 5 years - Plan IV:

Monthly mortgage payments increase 2% each year for 10 years - Plan V:

Monthly mortgage payments increase 3% each year for 10 years

Once the loan reaches the set time period of rate increase, monthly payments remain constant for the remainder of the mortgage term. Keep in mind that borrowers must make higher monthly payments toward the end of the loan as they'll begin to pay down the deferred debt.

Who's it For?

FHA's graduated payment mortgage program is available to finance single-family homes which must serve as the borrower's primary residence. The loan is ideally suited for low- to moderate-income who see their income levels increasing over the coming years. Buyers can tailor the monthly mortgage payments by picking the best plan, giving themselves the means to purchase a home sooner than they would be able to through conventional financing programs. In addition to the payment plans, GPMs come with FHA's flexible eligibility requirements, including low down payments and credit scores.

GPM borrowers should understand that over the life of the mortgage, they will pay more in interest than they would have had they chosen a mortgage with payments that remained the same over the life of the loan. While this type of loan is a great way to purchase a home earlier instead of renting, potential borrowers should also be critical and honest when assessing their future income increments and job security.

FHA Loan Articles

September 8, 2023Borrowers considering an FHA loan should be familiar with some basic loan terminology. These loans are popular among first-time homebuyers and those with lower credit scores because they often offer more flexible eligibility requirements and lower down payment options.

September 2, 2023You may have heard the terms co-borrower and cosigner in connection with your FHA loan process, but aren't sure about the distinction. Both a co-borrower and a cosigner can help a primary borrower qualify for a mortgage, but they have different roles and responsibilities.

August 27, 2023The Federal Housing Administration has specific credit requirements and guidelines for borrowers looking to buy or refinance homes with an FHA loan. In addition to what FHA guidelines state, lenders may have more stringent requirements that may vary from one lender to another.

August 23, 2023Mortgage APR (Annual Percentage Rate) and a loan's interest rate are two different things, although they are closely related. Understanding the difference is an important part of a borrower's analysis of the true cost of their mortgage.

August 19, 2023FHA refinance loans allow homeowners with existing FHA loans to refinance their mortgages. These loans are designed to help borrowers take advantage of lower interest rates, reduce their monthly mortgage payments, or access equity in their homes for various purposes.

August 14, 2023FHA loans typically require a minimum down payment of 3.5% of the purchase price of the home with the right credit score. This means that if you're buying a house for $240,000, you would need to make a down payment of at least $8,400.