FHA Loans: America's Favorite Mortgage

What appeals to many first-time homebuyers about FHA loans are the lenient eligibility requirements. But whether you're buying your first home, or just moving to a new one, the FHA loan program can help you finance a home with low down payments and flexible guidelines.

A popular FHA program is the fixed-rate mortgage, in which the interest rate remains the same through the term of the loan. With this constant interest rate, monthly payments don't change. Fixed-rate mortgages come with terms of 15 or 30 years.

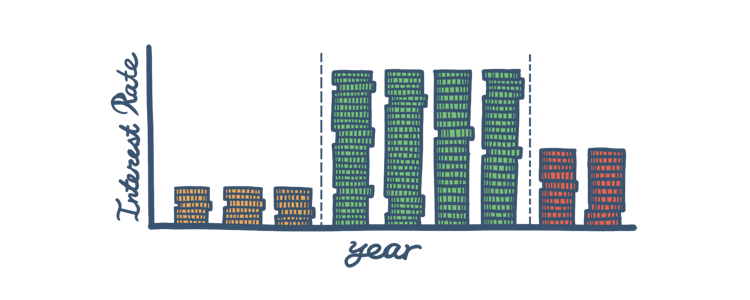

Adjustable-rate mortgages have an interest rate that—after an introductory period—varies for the life of the loan. The interest rate changes annually, going higher or lower, reflecting the fluctuating market indices approved by the FHA. The FHA has a few adjustable-rate mortgage options that can suit the needs of many borrowers.

This construction loan is an FHA program that finances the lot purchase, construction, and permanent loan of a new home in a single mortgage. You need only qualify once and pay a single set of closing costs. Your fixed-interest rate is locked in and the entire loan is in place before construction on your new home begins.

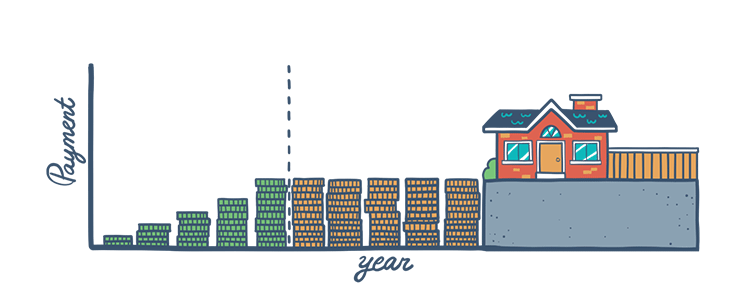

The FHA offers this type of loan to borrowers who expect their income to increase. The Graduated Payment Mortgage initially has low monthly payments that then gradually increase according to one of five available plans, which have varying lengths and rates.

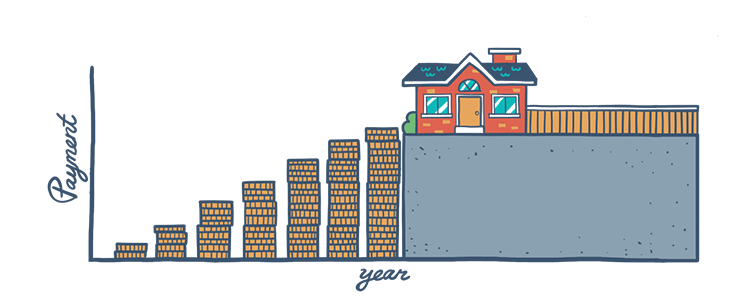

Growing Equity Mortgages (GEMs) are part of the FHA's Section 245(a) loan type that start off with lower initial payments, and increase according to a predetermined schedule over the life of the loan.

The FHA's Energy Efficient Mortgage program (EEM) finances energy-efficient home improvements for FHA borrowers. This helps homebuyers save money on household utility bills so that they can afford to make monthly payments on their home mortgage.

The FHA helps finance the purchase of condominiums with what is called a Section 234(c) loan. This loan can have a term of up to 30 years. It is primarily for residential condos that have at least two units and are located in an FHA-approved condominium projects.

FHA Loan Articles

November 22, 2023In the last days of November 2023, mortgage loan rates flirted with the 8% range but have since backed away, showing small but continued improvement. What does this mean for house hunters considering their options to become homeowners soon?

November 4, 2023In May 2023, USA Today published some facts and figures about the state of the housing market in America. If you are weighing your options for an FHA mortgage and trying to decide if it’s cheaper to buy or rent, your zip code may have a lot to do with the answers you get.

October 14, 2023FHA loan limits serve as a crucial mechanism to balance financial sustainability, regional variations in housing costs, and the agency's mission to promote homeownership, particularly for those with limited financial resources.

September 25, 2023Mortgage rates are hitting prospective homeowners hard this year and are approaching 8%, a rate that didn't seem very likely last winter. With so many people priced out of the market by the combination of high rates and a dwindling supply of homes.

September 19, 2023The FHA Handbook serves as a crucial resource for mortgage lenders, appraisers, underwriters, and other professionals involved in the origination and servicing of FHA-insured home loans. It outlines the policies and requirements for FHA-insured mortgages.

September 13, 2023FHA rehab loans are a specialized type of mortgage loan offered by the Federal Housing Administration that allows borrowers to finance both the purchase or refinance of a home and the cost of needed repairs.