Fixing Your Credit Score

January 10, 2023

To start improving your credit score, it helps to know what goes into making it. The factors that affect your score are:

- Timely payments: 35%

- Overall debt: 30%

- Length of credit: 15%

- New credit applications: 10%

- Types of credit: 10%

Know Your Score

You need to know what your score is if you want to get started on improving it for a home loan. According to the Fair Credit Reporting Act, individuals have the right to their own credit report, which is available from a credit bureau. You can request your report from these bureaus, the top three of which are Equifax, TransUnion, and Experian. Once you have your report, you can review it and dispute any discrepancies. The bureaus are responsible for investigating any disputes within 30 days.

Don’t Let Your Balance Go Past-Due

The most important factor that makes up your credit score is your payment history. 35% of your credit report depends on whether or not you make payments on time. The later you are on those payments, the worse it is for your credit report. Always try to pay off your credit balances in full. Not only does this keep you from incurring large interest payments, but having a “paid in full” remark on your credit report looks good to lenders considering you for a loan.

Building a Credit History from Scratch

Many first-time homebuyers run into the problem of not having a sufficient credit history. This can affect the 15% of your score that depends on age of credit. Establishing credit history can start with signing up for a credit card and using it to pay for everyday items. It also helps to set up utility payments through your credit card online. Just remember to pay off the balance on time!

Be Proactive About Opening New Lines of Credit

When applying for a loan or credit card, your bank or lender performs a “hard inquiry.” This is a review of your credit that in turn affects your score. If you submit multiple credit applications in a short timeframe, it shows up as a red flag for lenders. They might assume that you aren’t handling your finances well enough if you need multiple lines of credit open at once. It’s important that you don’t submit credit applications close to the time that you apply for a home loan.

Remember that your credit score represents your creditworthiness. Based on this number, a lender determines whether you are a high-risk borrower and if it’s a smart idea to loan you a huge amount of money. It also determines the interest rate you’ll receive from the lender, so it is worth your time to work on increasing your score.

------------------------------

RELATED VIDEOS:

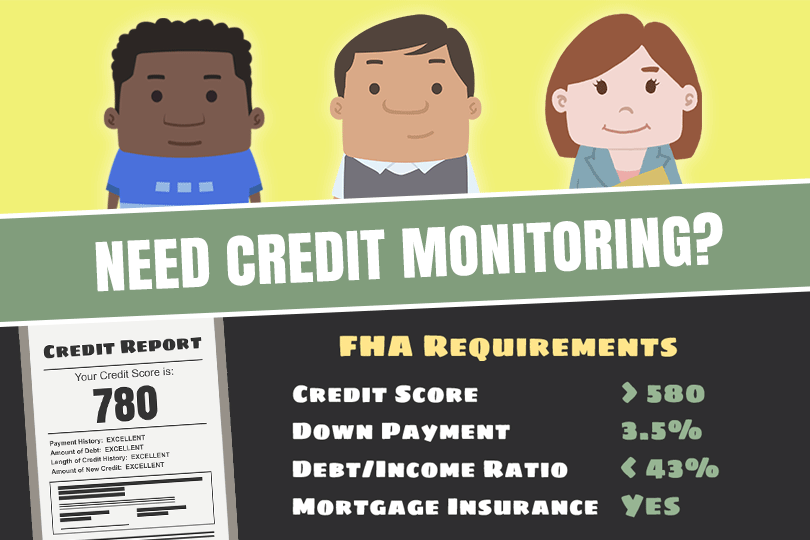

Learn How to Meet FHA Requirements

A Few Tips About Your Fixed Rate Mortgage

Your Proof of Ownership Is the Property Title

FHA Loan Articles

August 23, 2023Mortgage APR (Annual Percentage Rate) and a loan's interest rate are two different things, although they are closely related. Understanding the difference is an important part of a borrower's analysis of the true cost of their mortgage.

August 19, 2023FHA refinance loans allow homeowners with existing FHA loans to refinance their mortgages. These loans are designed to help borrowers take advantage of lower interest rates, reduce their monthly mortgage payments, or access equity in their homes for various purposes.

August 14, 2023FHA loans typically require a minimum down payment of 3.5% of the purchase price of the home with the right credit score. This means that if you're buying a house for $240,000, you would need to make a down payment of at least $8,400.

August 10, 2023FHA loans have specific rules and requirements for borrowers who have filed for bankruptcy. The guidelines can change over time, so it's essential to consult with a qualified lender or FHA-approved counselor for the most up-to-date information.

August 3, 2023FHA loans are primarily designed to help individuals and families purchase homes for use as their primary residences. Rules for these loans generally discourage their use for investment properties or rentals. However, there are exceptions that come with strict rules.