Beyond the Break-Even With FHA Discount Points

April 30, 2025

Discount points are an option for borrowers willing to pay a fee to lower the interest rate by a set amount. This is not right for all borrowers, and you don't want to pay for points you won't benefit from during the loan term.

That's why it pays to ask some critical questions. Are you a first-time homebuyer feeling overwhelmed by the process? Do you anticipate changes in financial or housing needs in the coming years?

The discount point question can be complicated. Calculating break-even points, projecting long-term savings, and weighing the opportunity cost of your capital is time-consuming and requires dedication.

For some FHA borrowers, accepting the lender's offered interest rate without the added layer of points can simplify the transaction. Doing so lowers the risk of making a decision they don't fully grasp or later regret. Sometimes, keeping things simple is best, but not always.

An important factor when weighing your discount points options is the possibility of refinancing your FHA loan in the future.

Interest rates are subject to market shifts. If rates experience a significant downturn, you might be able to refinance your FHA loan at a more favorable rate. If you've already paid for discount points on your original loan, the financial benefit of that upfront investment could be entirely negated by a future refinance.

If you think you may refinance in the coming years, paying for discount points now introduces the risk of that cost becoming a "sunk expense." Not all borrowers fully comprehend the mechanics of how points work and the extended timeframe often required to recoup their cost.

While lenders are responsible for clearly explaining the costs and potential savings, it's equally your responsibility to ask questions and ensure you thoroughly understand the implications.

Discount points are best for those who plan to keep the home and the original mortgage long-term. If that doesn't sound like you, avoiding paying for discount points may be best.

Remember, the goal is not just to get approved for the FHA loan, but to secure a loan that serves your long-term financial needs. Weigh the cost of buying points against the uncertain future benefits of doing so. Make your financial health the priority.

FHA Loan Articles

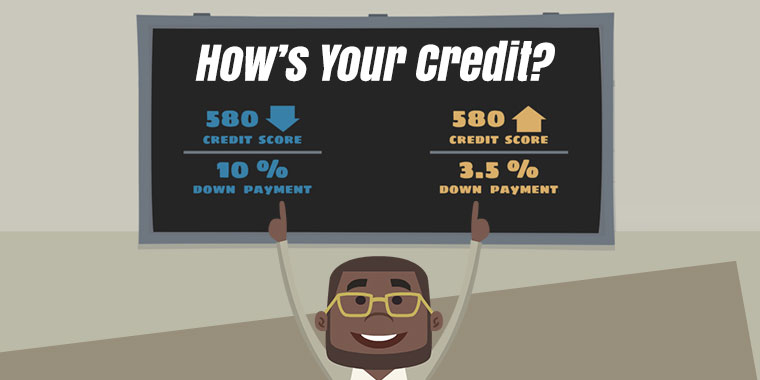

February 27, 2025 Buying your first home can feel overwhelming, especially when you start hearing terms like "subprime mortgages" and "FHA loans." Understanding these options is crucial for making the right decision. Subprime mortgages are designed for borrowers with less-than-perfect credit histories. This might include past issues like late payments, loan defaults, or even bankruptcy...

February 26, 2025Buying your first home can be exciting, but the mortgage process often throws a curveball of unfamiliar terms. Here are answers to common questions first-time homebuyers have about mortgage jargon and terms.

February 18, 2025Mortgages typically require mortgage insurance and homeowners insurance. They are both key parts of your home loan but they serve very different functions. Do you know the differences between the two? Find out how ready you are to begin the process of buying your new house.

February 17, 2025The federal government backs FHA home loans, which allows participating FHA lenders to offer lower down payment options and more lenient credit requirements. How much do you really know about your FHA home loan options and how they compare to other mortgage choices?

February 13, 2025For many college graduates, student loan debt is a concern. A common question is how this debt impacts the ability to buy a home. This Q&A explores the relationship between student loans and FHA loan approvals. How much do you know about how your student loan debt affects your ability to be approved for a mortgage?