Beyond the Break-Even With FHA Discount Points

April 30, 2025

Discount points are an option for borrowers willing to pay a fee to lower the interest rate by a set amount. This is not right for all borrowers, and you don't want to pay for points you won't benefit from during the loan term.

That's why it pays to ask some critical questions. Are you a first-time homebuyer feeling overwhelmed by the process? Do you anticipate changes in financial or housing needs in the coming years?

The discount point question can be complicated. Calculating break-even points, projecting long-term savings, and weighing the opportunity cost of your capital is time-consuming and requires dedication.

For some FHA borrowers, accepting the lender's offered interest rate without the added layer of points can simplify the transaction. Doing so lowers the risk of making a decision they don't fully grasp or later regret. Sometimes, keeping things simple is best, but not always.

An important factor when weighing your discount points options is the possibility of refinancing your FHA loan in the future.

Interest rates are subject to market shifts. If rates experience a significant downturn, you might be able to refinance your FHA loan at a more favorable rate. If you've already paid for discount points on your original loan, the financial benefit of that upfront investment could be entirely negated by a future refinance.

If you think you may refinance in the coming years, paying for discount points now introduces the risk of that cost becoming a "sunk expense." Not all borrowers fully comprehend the mechanics of how points work and the extended timeframe often required to recoup their cost.

While lenders are responsible for clearly explaining the costs and potential savings, it's equally your responsibility to ask questions and ensure you thoroughly understand the implications.

Discount points are best for those who plan to keep the home and the original mortgage long-term. If that doesn't sound like you, avoiding paying for discount points may be best.

Remember, the goal is not just to get approved for the FHA loan, but to secure a loan that serves your long-term financial needs. Weigh the cost of buying points against the uncertain future benefits of doing so. Make your financial health the priority.

FHA Loan Articles

January 15, 2025Buying a condo with an FHA loan is an option some don’t consider initially, but it’s worth adding to your list of potential property types. FHA loans for condo units traditionally require condo projects to be on or added to the FHA-approved list. Still, changes in policy over the years allow borrowers to apply for FHA loans on condo units in projects not on the list on a case-by-case basis.

December 30, 2024When applying for an FHA loan, lenders will consider more than just your credit scores and history. They also look at other factors affecting your risk profile and the interest rate they offer you.

One factor is occupancy type. For FHA loans, this is straightforward because these loans require owner occupancy. Investment properties aren't eligible. While conventional loans may have different rates for primary residences, second homes, and investment properties, this isn't a concern with FHA loans.

December 18, 2024Did holiday spending get the better of you? Are you looking for ways to recover your spending plan as you search for a new home?

The holidays are a whirlwind of festivities, family gatherings, and gift-giving. But amidst the cheer, it's easy to lose track of spending. If you're aiming to buy a home in the near future, those extra expenses can have a bigger impact than you might realize, especially if you're considering an FHA loan.

December 17, 2024The Federal Housing Administration provides mortgage insurance on loans made by FHA-approved lenders, making homeownership more attainable for those who might not qualify for conventional loans.

While financial factors like credit score and debt-to-income ratio are key to loan approval, other non-financial aspects can also cause a denial.

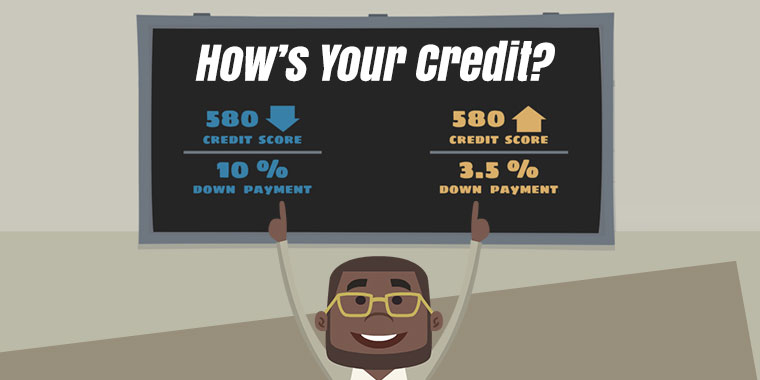

December 11, 2024FHA loans, insured by the Federal Housing Administration, are a popular choice for many homebuyers, especially those who need a lower downpayment or more forgiving credit qualifying requirements. FHA loans are primarily intended for primary residences—homes that borrowers will occupy as their main dwelling.