FHA Loans, New Borrowers, And Credit

November 27, 2024

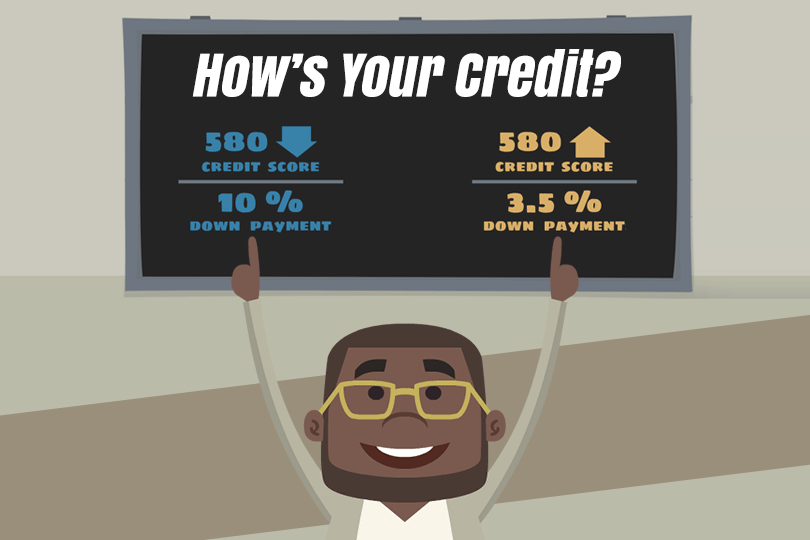

FHA Loans And Credit Scores

What follows is not financial advice. Always consult a finance or tax professional for the most current information.

While FHA loans offer more lenient credit score requirements, establishing a positive credit history is still vital in loan approval. You’ll need to know what your lender will see in your credit report long before you submit that information to them. How many credit mistakes are too many for your lender?

There is no set metric, but to understand how the lender thinks, remember that they have to justify approving your loan based on the information in your reports. Does the data in them make it easier or harder for the lender to say yes?

Lenders use credit reports to assess borrowers' creditworthiness and history of managing debt. Managing your financial obligations is a big part of loan approval. If you need to work on your credit, there are several ways to do so before a home loan application. Start working on these issues a year in advance at a minimum.

Building Credit

Several strategies exist for building credit. Secured credit cards, which require a security deposit, can help, but you will need time to build up your credit patterns with the new card.

Responsible use of a secured card can help build credit over time, as can credit-builder loans, which involve borrowing a small amount of money held in a savings account until the loan is repaid.

The activity on these loans is typically reported to credit bureaus, helping establish a credit history.

Consider becoming an authorized user on a responsible family member or friend's credit card. This, too, can help build credit since the account's payment history may be reported to credit bureaus.

Making consistent and on-time student loan payments demonstrates responsible debt management and contributes to a positive credit history. Some services allow renters to report their rent payments to credit bureaus, which can help establish a credit history.

Read Your Credit Reports

Request a free credit report from Equifax, Experian, and TransUnion. You are entitled to a free report annually to review for accuracy and identify problems.

Did you find errors or inaccuracies on your credit report? Dispute them immediately and set up credit monitoring services to track your credit score and stay informed of any changes.

FHA Loan Articles

April 16, 2025There are smart uses for cash-out refinancing loan proceeds and uses for that money that may work against the borrower. We examine some of those choices below, starting with using an FHA cash-out refinance for investment purposes. Is this a good idea?

April 15, 2025House hunters sometimes face a curveball when the appraisal for a home they want to buy with an FHA mortgage is lower than the offer. Is this a deal-breaker? Believe it or not, it isn't the end of the road. A low appraisal can sometimes be just a bump in the road. In other cases, you may wish to walk away from the deal. Here's your game plan to navigate this situation...

April 14, 2025 Buying a home with an FHA loan can be an exciting and achievable goal. This quick quiz helps you gauge your understanding of FHA loans and what it takes to make a winning offer on your new dream home. Take a few moments to answer the questions and see how prepared you are to navigate this crucial stage of your home-buying journey.

March 31, 2025Is 2025 the right year for you to consider an FHA streamline refinance? These mortgages are for those who want a lower interest rate, a lower monthly payment, or to move out of an adjustable-rate mortgage and into a fixed-rate loan. We examine some of the critical features of FHA streamline refinances.

March 27, 2025Did you know there are FHA loans that let house hunters buy multi-family properties such as duplexes and triplexes? FHA rules for these transactions is found in HUD 4000.1, including owner-occupancy, require that one unit serve as the borrower’s primary residence. Some house hunters ask why this rule exists. Some believe the rule serves as a lender risk mitigation strategy.