How Much Do I Need to Put Down on a House

September 20, 2021

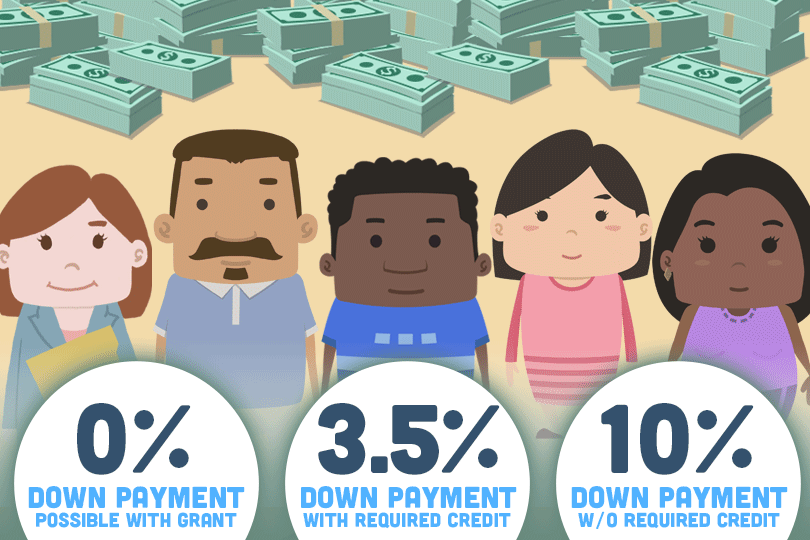

Minimum Down Payment Requirements

Different lenders have different requirements when it comes to the down payment on a home loan.

- FHA loans, backed by the Federal Housing Administration, require only 3.5% down with a 580 credit score.

- VA loans, insured by the U.S. Department of Veterans Affairs, for current and veteran military service members and eligible surviving spouses, have no down payment requirement.

- USDA loans, guaranteed by the U.S. Department of Agriculture's Rural Development Program, do not require a down payment.

- Most conventional loans (those not insured by the government), require a minimum down payment of 20%.

Lenders look favorably on borrowers who are able to make a sizeable down payment, as it gives them peace of mind. FHA-approved lenders feel more secure accepting a smaller down payment since they are insured by the government agency, and the lenders are protected in the case borrowers are unable to pay back the mortgage amount.

Mortgage Insurance

Applying for a conventional mortgage may mean paying for Private Mortgage Insurance (PMI). This is charged to borrowers when they are unable to make the minimum down payment (usually 20%) but still want to apply for it. While this option helps qualify for the loan, it also increases the cost of the loan itself. Borrowers can make a lower down payment upfront, but the monthly PMI premium is added to the mortgage payments. It is also important to remember that PMI does not protect the borrower. Instead, it protects the lender from losses if the borrower defaults on the loan. In most cases, borrowers will only have to pay for PMI until they have amassed enough equity in the home (usually up to the 20% requirement), and can have the premium dropped at that point. Talk to your loan officer to make sure this is an option.

How Down Payments Can Affect Your Interest

The amount of money directly impacts the amount of interest you pay over the life of the loan. Making a larger down payment means paying less in interest, since you are borrowing less money. Imagine that you are buying a $200,000-home with a down payment of $20,000. You will be paying interest on a $180,000 loan. (200,000 – 20,000). However, if you pay only $10,000 upfront, you will be paying interest on a $190,000-loan instead.

Trying to calculate how much money to put down on your home can be daunting, but having the information you need makes the decision easier. It is important that as a potential homebuyer that you do your research and learn about your options, including Down Payment Assistance Programs. Head to www.fha.com to for a comprehensive list of programs for each state.

------------------------------

RELATED VIDEOS:

Do What You Can to Avoid Foreclosure

Homes Financed With FHA Loans Must Be Owner Occupied

FHA Programs for First-Time Homebuyers

FHA Loan Articles

April 30, 2025 In a previous post, we discussed why FHA borrowers should carefully consider whether paying for discount points truly serves their best interests, focusing on factors like short-term homeownership, opportunity cost, FHA mortgage insurance, and the prevailing interest rate environment. Discount points are an option for borrowers willing to pay a fee to lower the interest rate by a set amount. This is not right for all borrowers, and you don't want to pay for points you won't benefit from during the loan term.

April 29, 2025Are you considering buying a home with an FHA loan? You'll likely talk to your participating lender about FHA loan "discount points" – fees you pay upfront for a lower interest rate on your mortgage. The idea behind discount points is a straightforward exchange: you spend money today to reduce your interest rate. Typically, one point equals one percent of your total FHA loan. In return, your interest rate might decrease by an amount you and the lender agree upon.

April 28, 2025Home loans have various expenses that aren't apparent to a new borrower until much later in the process. What do you need to consider when making your home loan budget? It might not be complete without addressing some of the issues we cover here.

April 23, 2025 While the prospect of lower interest rates or more favorable loan terms can be enticing, there are situations where waiting is the better option. Refinancing without carefully considering your current financial circumstances is never a good idea, but careful planning in the current financial environment is even more important.

April 22, 2025First-time home buyers worry about loan approval, but there are important steps to take to increase the likelihood that the lender will approve their application for the loan or pre-approval. What do you need to know before you choose a lender?