What Affects Credit Scores?

If you are about to apply for a home loan, it’s normal to be worried about your credit score and checking it often. You’re doing everything you can to secure a good interest rate, and a high credit score is essential for that.

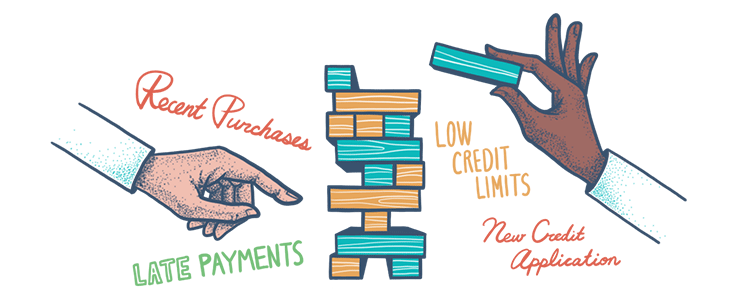

We’ve all heard, from multiple sources, what is and isn’t good for your credit. Many well-meaning people might give you advice about the dos and don’ts to help you keep your scores up. But it’s likely that you’ve come across some misinformation along the way. Here are the facts!

Credit Score Considerations

AN EXPENSIVE PURCHASE

You might see your credit score drop after making a big purchase for which you use a large portion of your available credit limit. It surprises many credit card holders when the score drops even after they pay off the balance in full on their due date. This is because lenders see you using a large amount of your available credit and assume you are not managing your finances efficiently. The good news is that it's easy enough to recover those lost points by paying down the balance on time and holding off on other large credit card purchases.

PAYMENTS MORE THAN 30 DAYS LATE

Your payment history accounts for 35% of your FICO score, so it makes sense that a late payment can significantly lower your score. Any payments, whether they’re on your credit card or other loans, that are more than 30 days past due are reported to the credit bureaus and are then reflected in your credit score.

LOWERED CREDIT LIMITS

You may not always have control over this, but your credit score can take a hit when your available credit is lowered. Similar to when you make an expensive purchase, lowering your available credit on a credit card means the portion you utilize goes up, and your credit score goes down. In the case you’re your bank lowers your limit, a good way to avoid your credit score dropping is to avoid using more than 30% of the available credit line.

NEW CREDIT APPLICATION

An inquiry is added to your credit report any time you put in an application for credit, and this makes up 10% of your overall score. Inquiries stay on your credit report for two years, but are factored into your score for only one year.

Myths About Credit Scores

YOUR INCOME LEVEL AFFECTS YOUR SCORE. NOT TRUE!

Credit bureaus do not consider information about your job, salary when calculating your scores. Employer information may be listed on your credit report, but your actual income is not. When you apply for a loan, a lender may ask for your salary to determine how much you can afford to borrow, but your income does not impact your credit score.

CHECKING YOUR OWN CREDIT IS HARMFUL. NOT TRUE!

When a lender does a credit check, it’s considered a “hard” inquiry that affects your credit score. But if you’re curious about your own score, there are many reputable sources where you can get a “soft” credit check without it bringing down any points on your score.

PAYING OFF HIGH INTEREST RATE DEBT HURTS YOUR SCORE. NOT TRUE!

Just because you may have a high interest rate on your credit cards or loans doesn’t mean it’s going to affect your credit score and keep you from getting a low rate in the future. It’s true that the higher your credit score is, the lower interest rate you’ll get from a lender, but it doesn’t work the other way around.

BANK OVERDRAFTS ARE AS BAD AS LATE PAYMENTS. NOT TRUE!

Overdrawing your bank account can result in you having to pay fees, and that can get expensive. But this doesn’t affect your credit score the way a late payment does. As long as you clear up the overdraft and pay the penalty fees before your account is sent to a collection agency, your score does not a hit. However, once your account goes to collections, it is considered an unpaid debt, and that can bring down your score.

FHA Loan Articles

February 12, 2024When you are approved for an FHA One-Time Close Construction loan, you get a single loan that pays for both the costs to build the house, and serves as the mortgage. One application, one approval process, and one closing date.

November 22, 2023In the last days of November 2023, mortgage loan rates flirted with the 8% range but have since backed away, showing small but continued improvement. What does this mean for house hunters considering their options to become homeowners soon?

November 4, 2023In May 2023, USA Today published some facts and figures about the state of the housing market in America. If you are weighing your options for an FHA mortgage and trying to decide if it’s cheaper to buy or rent, your zip code may have a lot to do with the answers you get.

October 14, 2023FHA loan limits serve as a crucial mechanism to balance financial sustainability, regional variations in housing costs, and the agency's mission to promote homeownership, particularly for those with limited financial resources.

September 25, 2023Mortgage rates are hitting prospective homeowners hard this year and are approaching 8%, a rate that didn't seem very likely last winter. With so many people priced out of the market by the combination of high rates and a dwindling supply of homes.

September 19, 2023The FHA Handbook serves as a crucial resource for mortgage lenders, appraisers, underwriters, and other professionals involved in the origination and servicing of FHA-insured home loans. It outlines the policies and requirements for FHA-insured mortgages.