FHA Reverse Mortgage

Reverse mortgages have become increasingly popular with seniors who have equity in their homes and want to supplement their income. The FHA insures a reverse mortgage called the Home Equity Conversion Mortgage (HECM) that is available through FHA-approved lenders. These loans are available to homeowners aged 62 or older who have paid off or paid down a considerable amount of their mortgage.

How it Works

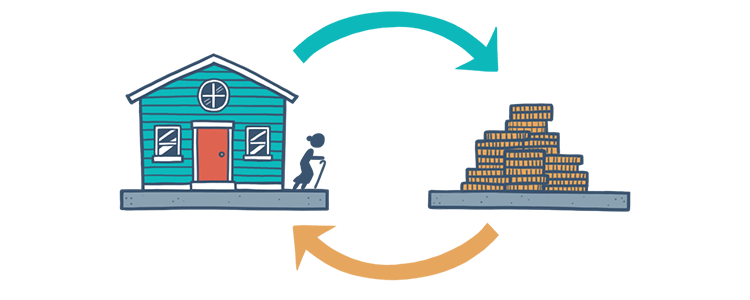

The FHA’s reverse mortgage program lets you to withdraw a portion of your home's equity. The amount that will be available for withdrawal varies by borrower. It depends on the age of the youngest borrower or eligible non-borrowing spouse, the current interest rate, and lesser of the appraised value or the HECM FHA mortgage limit or the sales price.

Funds can be received in the following formats:

- Equal monthly payments for the rest of your life.

- Equal monthly payment for an agreed period.

- A line of credit, though there are caps on the size of some lump-sum withdrawals.

The principal and interest are due for repayment when the home is sold, or when the borrower dies. FHA mortgage insurance is also required with such a loan, which can be financed as part of the loan as well.

Who's it For?

To be eligible for an FHA reverse mortgage, you need to be compliant with the eligibility criteria.

- You must be 62 years or older.

- You must own the home outright or paid-down a considerable amount.

- You must occupy the home as your primary residence.

- You must remain current on property taxes, homeowner’s insurance, and other mandatory obligations.

- You must participate in a consumer information session led by a HUD-approved counselor.

- You must maintain your property and keep it in good working condition.

- You must complete a consumer information session given by a HUD-approved HECM counselor.

There are also some property guidelines your house must fall under to be eligible for an HECM. It must be a single-family home or 2- to 4-unit home with one unit occupied by the borrower, a HUD-approved condominium project, or a manufactured home that meets FHA requirements.