Frequently Asked Questions About Home Insurance with an FHA Mortgage

May 14, 2025

There are important nuances to these insurance policies to know before you start. What's the difference between insurance against water damage and flood insurance? As we'll explore below, that's just one example of the "hidden" expenses of buying your new home to budget for.

What kinds of insurance do I need when buying a house with an FHA mortgage?

If you purchase a home using an FHA residential real estate mortgage, you will primarily need to have FHA Mortgage Insurance Premium (MIP) and homeowner's insurance. Additionally, depending on your circumstances and the location of your property, you might need other types of insurance for full protection.

The FHA Mortgage Insurance Premium, or MIP, is a type of insurance that protects the lender against financial loss if you, the borrower, default on your loan. It helps make FHA loans available to a wider range of people.

What are the different parts of the FHA MIP?

The FHA MIP has two parts: the Upfront Mortgage Insurance Premium (UFMIP) and the Annual Mortgage Insurance Premium (Annual MIP).

What is the Upfront Mortgage Insurance Premium (UFMIP)?

The UFMIP is a one-time fee that you typically pay when you close on your house. It is usually a percentage of your total loan amount. While you can pay it in cash at closing, it's also common to add it to your loan balance.

What is the Annual Mortgage Insurance Premium (Annual MIP)?

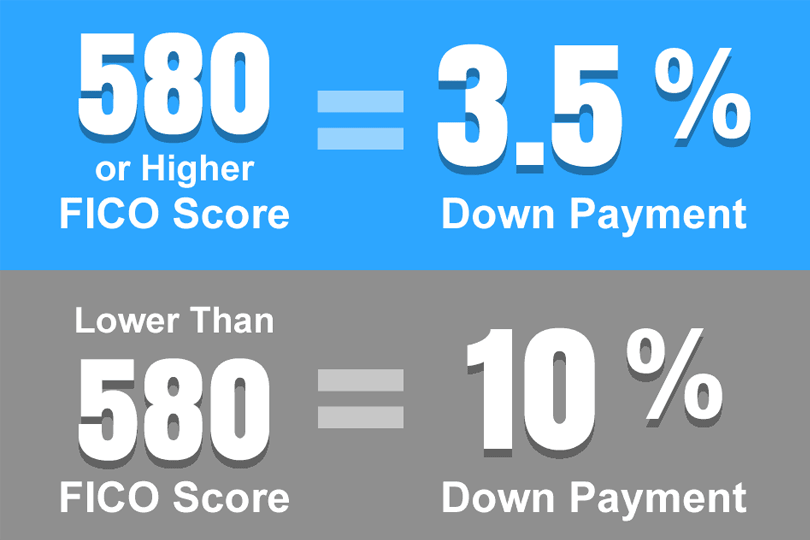

The Annual MIP is an ongoing monthly payment that you make as part of your regular mortgage payment. The amount you pay depends on your loan amount, the length of your loan, and the size of your down payment.

Why do I have to pay the FHA Mortgage Insurance Premium?

The FHA MIP is required because FHA loans are designed to help people who might not qualify for traditional loans, often those with lower down payments or less-than-perfect credit. The MIP reduces the risk for lenders, allowing them to offer these loans.

What is homeowner's insurance (hazard insurance)?

Homeowner's insurance, often called hazard insurance when talking about mortgages, is another type of insurance you must have with an FHA loan. It protects the lender's investment, which is your house itself, from physical damage.

What does a standard homeowner's insurance policy usually cover?

A typical homeowner's insurance policy includes coverage for the structure of your house, other structures on your property, your personal belongings inside the house, additional living expenses if you have to move out temporarily due to a covered loss, liability if someone is injured on your property, and minor medical payments for guests injured on your property.

What kinds of events are typically covered by homeowners' insurance?

Homeowner's insurance usually covers events like fire, windstorms, hail, explosions, riots, damage from aircraft or vehicles, smoke, vandalism, theft, falling objects, the weight of snow or ice, and some types of water damage from things like burst pipes.

Are there things that homeowner's insurance typically doesn't cover?

Yes, most homeowners' policies do not cover earthquakes, floods, landslides, sewer backups (though you can often add this coverage), neglect, pests, and damage from war or nuclear events.

FHA Loan Articles

April 28, 2025Home loans have various expenses that aren't apparent to a new borrower until much later in the process. What do you need to consider when making your home loan budget? It might not be complete without addressing some of the issues we cover here.

April 23, 2025 While the prospect of lower interest rates or more favorable loan terms can be enticing, there are situations where waiting is the better option. Refinancing without carefully considering your current financial circumstances is never a good idea, but careful planning in the current financial environment is even more important.

April 22, 2025First-time home buyers worry about loan approval, but there are important steps to take to increase the likelihood that the lender will approve their application for the loan or pre-approval. What do you need to know before you choose a lender?

April 16, 2025There are smart uses for cash-out refinancing loan proceeds and uses for that money that may work against the borrower. We examine some of those choices below, starting with using an FHA cash-out refinance for investment purposes. Is this a good idea?

April 15, 2025House hunters sometimes face a curveball when the appraisal for a home they want to buy with an FHA mortgage is lower than the offer. Is this a deal-breaker? Believe it or not, it isn't the end of the road. A low appraisal can sometimes be just a bump in the road. In other cases, you may wish to walk away from the deal. Here's your game plan to navigate this situation...