Growing Equity Mortgage

Growing Equity Mortgages (GEMs) are part of the FHA’s Section 245(a) loan type that start off with lower initial payments, and increase according to a predetermined schedule over the life of the loan. Similar to a Graduated Payment Mortgage, GEMs are a good option for potential homebuyers who expect higher earnings in the future.

How Does a GEM Work?

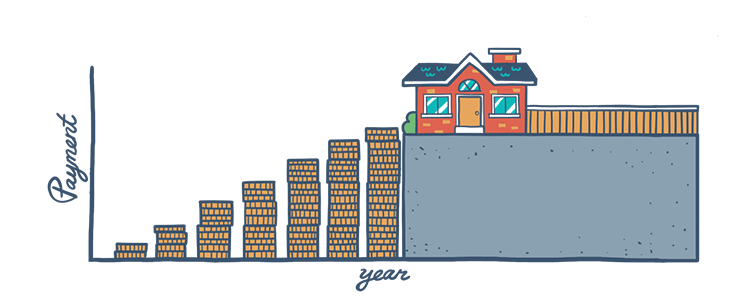

Growing Equity Mortgages allow you to purchase a home sooner than you would be able to with most other financing options. There is an introductory year during which your monthly payments are based on a 30-year, fixed-rate schedule. After this initial year ends, your payments increase annually at a fixed rate, depending on the plan that you choose.

The FHA offers five different GEM plans:

- Plan I (Code L):

1% fixed increase per year - Plan II (Code M):

2% fixed increase per year - Plan III (Code N):

3% fixed increase per year - Plan IV (Code O):

4% fixed increase per year - Plan V (Code P):

5% fixed increase per year

GEMs are popular because they can help you own your home sooner. While your introductory payments are calculated based on a 30-year mortgage model, the actual term of your loan is shorter due to the increasing annual payment rate. Your loan term should not exceed 22 years with the lowest plan of a 1% increase, and can be as short as 15 years with the 5% increase.

Every month, more and more money goes towards the principal amount, and the mortgage is paid off faster, which helps you save on interest. So instead of paying interest over 30 years, you'll pay only as long as it takes to pay off the full principal balance, which is a shorter amount of time due to the GEM guidelines.

Who's it For?

Unlike a Graduated Payment Mortgage, a GEM’s scheduled increments of monthly payments result in a shorter loan term and lower cost to the borrower, because it comes without the risk of negative amortization that can lead to an unmanageable balloon payment.

Though HUD’s 245(a) program was designed to assist low-income first-time homebuyers purchase a home sooner than they would be able to with conventional mortgages, it is open to repeat homebuyers as well. They can all take advantage of the FHA’s lenient qualification requirements such as low down payments and credit scores.

Similar to a Graduated Payment Mortgages, this type of home loan is only eligible to purchase single-family properties or condominiums that will serve as the borrower’s primary residence and not an investment property. This loan type is ideal for borrowers who expect to see a rise in their income and want to own a home sooner. However, it is also important that borrowers be completely positive of their future earning potential and job security when deciding to finance their home with a Growing Equity Mortgage.

FHA Loan Articles

September 8, 2023Borrowers considering an FHA loan should be familiar with some basic loan terminology. These loans are popular among first-time homebuyers and those with lower credit scores because they often offer more flexible eligibility requirements and lower down payment options.

September 2, 2023You may have heard the terms co-borrower and cosigner in connection with your FHA loan process, but aren't sure about the distinction. Both a co-borrower and a cosigner can help a primary borrower qualify for a mortgage, but they have different roles and responsibilities.

August 27, 2023The Federal Housing Administration has specific credit requirements and guidelines for borrowers looking to buy or refinance homes with an FHA loan. In addition to what FHA guidelines state, lenders may have more stringent requirements that may vary from one lender to another.

August 23, 2023Mortgage APR (Annual Percentage Rate) and a loan's interest rate are two different things, although they are closely related. Understanding the difference is an important part of a borrower's analysis of the true cost of their mortgage.

August 19, 2023FHA refinance loans allow homeowners with existing FHA loans to refinance their mortgages. These loans are designed to help borrowers take advantage of lower interest rates, reduce their monthly mortgage payments, or access equity in their homes for various purposes.

August 14, 2023FHA loans typically require a minimum down payment of 3.5% of the purchase price of the home with the right credit score. This means that if you're buying a house for $240,000, you would need to make a down payment of at least $8,400.