Understanding FHA Loan Debt Ratios

July 29, 2023

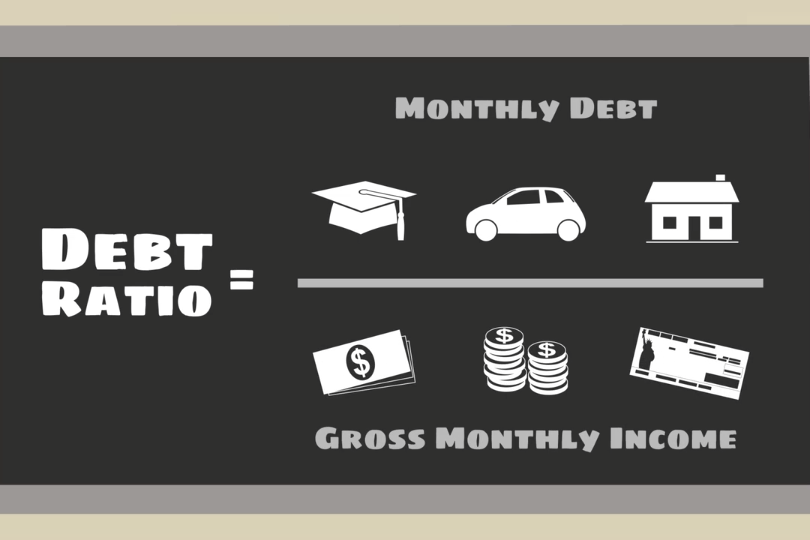

FHA loan debt ratios are financial benchmarks that assess a borrower's ability to manage their debt and make mortgage payments on time. These ratios play a pivotal role in the FHA loan approval process, as they provide a snapshot of a borrower's financial health. Two primary debt ratios are considered when evaluating an applicant's eligibility for an FHA loan:

Front-End Ratio (Housing Ratio)

This measures the percentage of a borrower's monthly gross income that will be allocated to housing-related expenses. These expenses include mortgage principal and interest, property taxes, homeowners insurance, and mortgage insurance premiums (if applicable). FHA guidelines typically require that the housing ratio does not exceed 31% of the borrower's gross income.

Back-End Ratio (Total Debt Ratio)

This is a broader measure of a borrower's debt load. It considers not only housing-related expenses but also other monthly obligations such as car loans, credit card payments, student loans, and any other outstanding debts. The FHA generally sets a maximum allowable back-end ratio of 43% of the borrower's gross income.

To improve your back-end ratio, focus on paying down existing debts, such as credit cards and personal loans. Reducing your overall debt load can make you a more attractive candidate for an FHA loan.

Both of these ratios serve as vital tools for lenders to assess your financial health and determine your eligibility for financing. By managing your debt wisely, increasing your income, and budgeting carefully, you can improve your debt ratios and increase your chances of securing an FHA loan. Remember that while debt ratios are an essential part of the approval process, they are just one piece of the puzzle, and other factors like credit score and down payment also play a role in determining your loan eligibility.

------------------------------

RELATED VIDEOS:

Let's Talk About Home Equity

Understanding Your Loan Term

Your Home Loan is Called a Mortgage

FHA Loan Articles

March 13, 2024There are plenty of reasons to delay plans to refinance a home. One reason has made big headlines. When borrowers face higher interest rates than originally approved for, that is a good reason to wait to refinance.

February 12, 2024When you are approved for an FHA One-Time Close Construction loan, you get a single loan that pays for both the costs to build the house, and serves as the mortgage. One application, one approval process, and one closing date.

November 22, 2023In the last days of November 2023, mortgage loan rates flirted with the 8% range but have since backed away, showing small but continued improvement. What does this mean for house hunters considering their options to become homeowners soon?

November 4, 2023In May 2023, USA Today published some facts and figures about the state of the housing market in America. If you are weighing your options for an FHA mortgage and trying to decide if it’s cheaper to buy or rent, your zip code may have a lot to do with the answers you get.

October 14, 2023FHA loan limits serve as a crucial mechanism to balance financial sustainability, regional variations in housing costs, and the agency's mission to promote homeownership, particularly for those with limited financial resources.