Non-Financial Factors That Affect Home Loan Interest Rates

December 30, 2024

One factor is occupancy type. For FHA loans, this is straightforward because these loans require owner occupancy. Investment properties aren't eligible. While conventional loans may have different rates for primary residences, second homes, and investment properties, this isn't a concern with FHA loans.

Some might not immediately know which loan is best for them, but knowing the occupancy requirement ahead of time can help them make a more informed choice.

Your employment history is another factor. A stable job with consistent income shows lenders you're reliable and can make your mortgage payments. They'll look at how long you've been employed, your income stability, and your industry. Building a strong employment profile can help you get a better interest rate if the lender feels that history shows you are a good credit risk.

The loan term and payoff schedule also play a role. The loan term affects your monthly payments and total interest costs.

The amortization schedule determines how your payments are applied to principal and interest over time. Your lender may offer different interest rates for a 15-year loan compared to a 30-year mortgage, for example.

Standard amortization has early payments mostly going toward interest, while graduated payment mortgages have payments that start lower and increase over time.

Your income projections and financial goals will influence your choice of amortization schedule, and your lender may offer different interest rates for different loan terms and amortization schedules.

Remember, lenders consider various factors when determining your FHA loan interest rate. Understanding these factors can help you make informed decisions and potentially secure a lower rate.

FHA Loan Articles

February 12, 2025Choosing between FHA and conventional home loans can be daunting for some first-time home buyers. What are the concerns between these two programs, and what does each one offer the borrower? We examine some of the key issues in our question-and-answer session about FHA mortgages versus conventional loans.

February 11, 2025Established in 1934 as part of the National Housing Act, the FHA's primary mission is to stimulate the housing market by providing mortgage insurance to lenders. This insurance reduces the risk associated with lending to borrowers who may otherwise be considered higher risk, encouraging lenders to offer more favorable terms, such as lower down payments and more flexible credit requirements. A key element of the FHA program is its commitment to fair housing, which is deeply rooted in the Fair Housing Act.

February 10, 2025How much do you really know about the home buying process? One major factor in protecting your new investment is knowing how the title search process works and why you need to have one done. This quiz will assess your comprehension of what a title search entails, why it's so important when using an FHA loan, and how it protects you as a buyer. From identifying potential liens to guaranteeing clear ownership, a title search plays a critical role.

January 30, 2025FHA residential refinance loans, insured by the Federal Housing Administration, allow homeowners to refinance their existing mortgages. They potentially have more flexible qualification requirements than conventional loans. FHA refi loans can lower monthly payments, shorten the loan term, consolidate debt, or even access cash for home improvements or other needs. Understanding the eligibility criteria and different refinance options is crucial for homeowners considering this option.

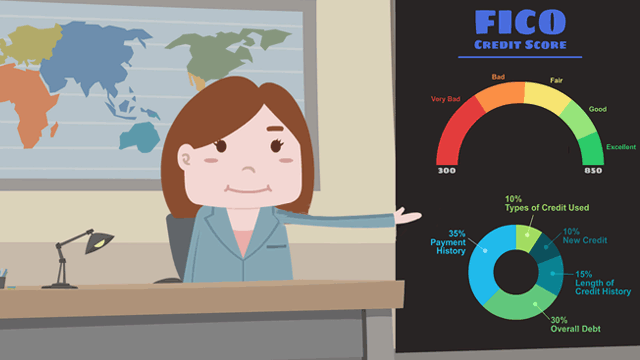

January 29, 2025Are you about to graduate from college and are already thinking of what your dream home might look like? Understanding the intricacies of the mortgage is an essential step in your journey toward home ownership. Two key terms you'll encounter early on are "FICO score" and "credit history." How do these two things affect your ability to buy a home?