Debt-to-Income Ratios

If FHA borrowers start to default on their homes, it defeats the main purpose of the FHA. That's why there are certain criteria in place to ensure that homebuyers are not signing up for home loans that they cannot reasonably afford and pay back. Since the FHA has no minimum income requirement, it relies on the borrowers' debt-to-income ratio to determine whether they have the means to make monthly payments.

What Are Debt Ratios?

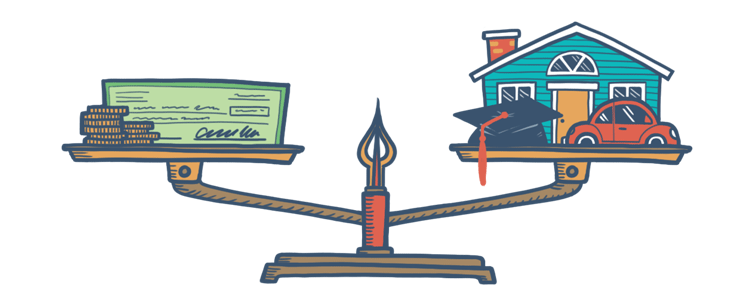

Your debt-to-income ratio (also called a debt ratio) gives lenders a clear picture of how much you owe each month to how much you earn. The debt ratio is calculated by dividing the sum of your monthly debts and dividing it by your total assets.

For your monthly debt, the FHA take into account all the money you owe: credit card or lines of credit payments, car payments, student loan payments, taxes, insurance, alimony and child support, as well as the amount of your potential new house payment. Your pre-tax income, wages, tips, child support, social security, amounts to your total monthly assets. The number you arrive at after dividing your total debt by assets is your debt-to-income ratio.

The FHA's Debt Ratio Limits

According to HUD Handbook 4000.1, FHA borrowers can have a “maximum qualifying ratio” 43%. Add up the total mortgage payment for your potential new home (principal and interest, escrow deposits for taxes, hazard insurance, mortgage insurance premium, homeowners' dues, etc.) as well as your recurring monthly debt (car loans, personal loans, student loans, credit cards, etc.). Then divide that amount by your gross monthly income. That number should fall under 43% to qualify.

Many borrowers may have a high enough credit score to qualify for FHA loans and be able to make the down payment as well. But your debt-to-income ratio plays a big role in a lender determining whether you should be granted a loan. A good credit report is important, and it shows lenders that you have a history of making payments on time. But a debt ratio that's too high tells them that you have high monthly expenses compared to how much money you earn and that you might not be the best at budgeting.

The FHA makes some discretionary exceptions for borrowers with debt ratios higher than 43% based on certain “compensating factors.” Borrowers who have higher credit scores, verified cash reserves, or Energy Efficient homes might be granted a loan despite higher debt-to-income ratios.

FHA Loan Articles

April 18, 2023Your lender is required to make sure you can realistically afford your mortgage, and that means verifying that your income is stable, reliable, and will continue after your mortgage has closed. What some don’t realize about this process is that there are standards for verifying income.

March 16, 2023Planning your FHA loan means asking some important questions early in the process. The most obvious question is associated with the type of home you want. How large a house do you need? FHA mortgages allow the purchase of homes with between one and four living units.

February 7, 2023There are tons of reasons why people decide that they’re done with renting and start looking into buying a home. Whatever your reason, deciding to buy a home is a big step, and one of the most daunting aspects is saving up enough money for the down payment.

January 27, 2023Before you get ready to commit to a home loan application, it’s good to review your circumstances and ask a few basic questions about your loan, your plans, and the home itself. Believe it or not, knowing what type of home loan you need is an important step.

November 30, 2022Buying and financing a home is complicated and can become overwhelming. It's important for you to stay informed, and know what your options are. So, start with the basics and read about the four different mortgage types available before approaching a lender.

November 8, 2022The fact is that repairs and renovations to your home cost a lot of money. Luckily, the FHA has an option for those with fixer-uppers on their hands. The FHA 203(k) Rehabilitation Mortgages allows borrowers to finance the funds for renovations to a home.