Adjustable Rate Mortgage

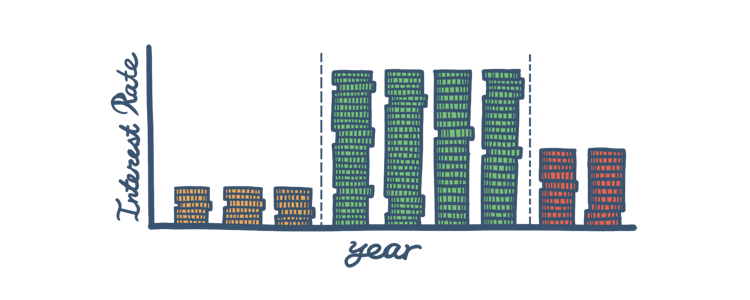

An adjustable-rate mortgage (ARM) has an interest rate that changes periodically through the life of the loan. ARMs come with an introductory period with a low, fixed rate. After this initial period, the interest rate applied to the outstanding balance varies based on the market index.

How the FHA ARM Works

The interest rate you get after the initial period is over is based on an index and your lender’s margin (which should be disclosed when you apply for the loan). The new interest rate is calculated by adding the margin to the index. As the index figure changes, so will your interest rate. The FHA accepts market index figures of the Constant Maturity Treasury (CMT) index or the 1-year London Interbank Offered Rate (LIBOR).

The idea of a large swing in the interest rates might make an ARM less appealing. That’s why the FHA places two types of caps, to provide a safeguard from astronomically high (or low) rates. There is an annual cap, which limits the points your interest rate can change year to year, and a “life-of-the-loan” cap that restricts the amount it can vary for the entire term of the loan.

FHA's ARM

The FHA has a few adjustable-rate mortgage options that can suit the needs of many borrowers. It offers a standard 1-year ARM and four "hybrid" ARM products, which have an initial interest rate that is fixed for the first 3, 5, 7, or 10 years. After that initial period, the interest rate adjusts annually.

The Pros

Choosing to finance a home with an ARM can work extremely well for some borrowers for a few reasons.

- Borrowers who intend to move and sell their home within a few years can take advantage of the low interest rates that come with the initial period of an adjustable-rate mortgage.

- Many homebuyers use the introductory period to save and budget for the future.

- Some borrowers may be expecting a significant increase in their income.

The Cons

It’s important to remember the downsides that come with the uncertainty of ARMs in order to make the best decision.

- There is always the chance that the index can go up drastically and your interest rate can skyrocket.

- When there is an uncertainty of how much you’ll be spending on monthly mortgage payments, budgeting isn’t as easy to do.

FHA Loan Articles

July 2, 2023Buying a home is a significant milestone in life, and for many, it's a dream come true. However, the path to homeownership can be fraught with challenges, and one of the most concerning issues can be high FHA loan interest rates.

June 15, 2023When you buy a home with an FHA mortgage, cash for closing costs and your down payment is required. It would be easy to assume you simply give the lender cash in the specified amount and that’s the end of the story.

May 20, 2023Did you know there is an FHA loan option that lets you build a house from the ground up? You can use this mortgage to build on land you own or on land you buy as part of the loan. But you will want to address some issues comparing construction loan options.

May 3, 2023Sometimes when buying a home there may be a question of surplus or excess land. You likely won’t face this issue when buying a condo unit, but for other types of purchases, this may be an important factor in the appraisal process.

April 18, 2023Your lender is required to make sure you can realistically afford your mortgage, and that means verifying that your income is stable, reliable, and will continue after your mortgage has closed. What some don’t realize about this process is that there are standards for verifying income.

March 16, 2023Planning your FHA loan means asking some important questions early in the process. The most obvious question is associated with the type of home you want. How large a house do you need? FHA mortgages allow the purchase of homes with between one and four living units.