Your Credit Score and FHA Loans

Your credit score plays a big role in determining how your mortgage experience turns out. A good one can help you secure a low interest rate mortgage with a smaller down payment, because it shows lenders that you’re creditworthy. On the other hand, a lower score can severely hurt your chances of getting approved for a loan.

What makes a good score? What score do you need for lenders to consider you a “good risk”? We’ve compiled some important information about credit scores and reporting that will help you understand exactly what that number represents in an effort to help you increase it to where your lender needs it to be.

Borrowers hear the term “credit report” a lot when they enter the homebuying market, but don’t always know what goes into it. Your credit report is compiled with different information about your spending and payment habits. Learn about all the factors that go into your credit score, what a FICO score really means, and what credit bureaus really do.

Even if you’ve made some mistakes in the past, it is possible to improve your credit score if you decide to put in the work. But before you can fix the problem, you need to know the point you’re starting at. Read about the steps you can take to increase your score so you can ensure a low-interest loan when the time comes for you to apply for a mortgage.

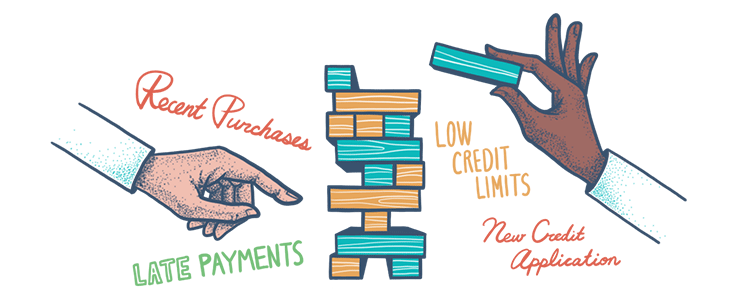

When shopping for a mortgage, many people will tell you what is and isn’t good for your credit score. They might give you advice about the dos and don’ts to help you keep your scores up. But it’s likely that you’ve come across some misinformation along the way. Read the facts about what affects your score, and check out some of the credit score myths as well!

While the Federal Housing Administration has set low credit score requirements for the loans they will insure, lenders providing the mortgages may not approve a loan for borrowers with lower scores. It is very common that lenders have their own, additional requirements for FHA loans that they grant, generally called “overlays.”

FHA Loan Articles

October 17, 2022If you’ve begun your search for a new home and are looking into mortgage options, you’ve likely heard of mobile, manufactured, and modular homes. While people working in real estate throw these terms around easily, it might be something that leaves everyday homebuyers confused.

August 23, 2022Credit scores tend to be a source of anxiety for many Americans, because they realize the weight they hold when it comes to getting a loan for nearly anything. Taking the mystery out of this 3-digit number goes a long way to helping people understand and increasing their score.

June 16, 2022It’s a great option to consider if you want to build your dream home on your own land instead of buying someone else’s already-lived-in house. FHA One-Time Close mortgages are also referred to as single-close construction loans--you’ll see these terms used interchangeably.

February 24, 2022One of the major hurdles that keeps families from purchasing a home is the need for a down payment. The FHA’s goal is to offer more homebuying opportunities to low- and moderate-income Americans and set more easily achievable down payment requirements for borrowers.

January 31, 2022One of the first steps to take when you decide to buy a home is getting pre-approved for a mortgage. It is important to know what it means to get pre-approved for a home loan, and what the pre-approval letter does and doesn’t do for your home buying chances.

January 10, 2022A home loan is one of the most important investments you can make. Buying a home means owning property, and being a homeowner means there's potential to watch your investment grow in value over time. But first, the lender has to make sure the borrower is a good credit risk.