Growing Equity Mortgage

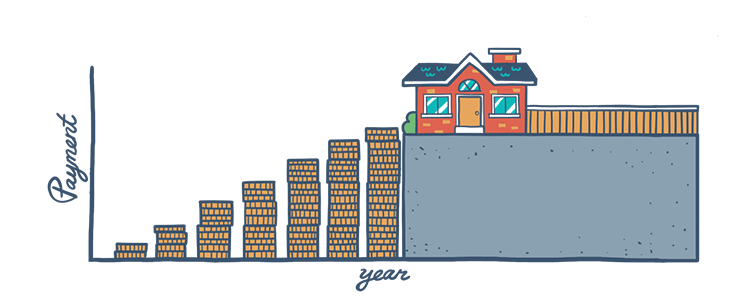

Growing Equity Mortgages (GEMs) are part of the FHA’s Section 245(a) loan type that start off with lower initial payments, and increase according to a predetermined schedule over the life of the loan. Similar to a Graduated Payment Mortgage, GEMs are a good option for potential homebuyers who expect higher earnings in the future.

How Does a GEM Work?

Growing Equity Mortgages allow you to purchase a home sooner than you would be able to with most other financing options. There is an introductory year during which your monthly payments are based on a 30-year, fixed-rate schedule. After this initial year ends, your payments increase annually at a fixed rate, depending on the plan that you choose.

The FHA offers five different GEM plans:

- Plan I (Code L):

1% fixed increase per year - Plan II (Code M):

2% fixed increase per year - Plan III (Code N):

3% fixed increase per year - Plan IV (Code O):

4% fixed increase per year - Plan V (Code P):

5% fixed increase per year

GEMs are popular because they can help you own your home sooner. While your introductory payments are calculated based on a 30-year mortgage model, the actual term of your loan is shorter due to the increasing annual payment rate. Your loan term should not exceed 22 years with the lowest plan of a 1% increase, and can be as short as 15 years with the 5% increase.

Every month, more and more money goes towards the principal amount, and the mortgage is paid off faster, which helps you save on interest. So instead of paying interest over 30 years, you'll pay only as long as it takes to pay off the full principal balance, which is a shorter amount of time due to the GEM guidelines.

Who's it For?

Unlike a Graduated Payment Mortgage, a GEM’s scheduled increments of monthly payments result in a shorter loan term and lower cost to the borrower, because it comes without the risk of negative amortization that can lead to an unmanageable balloon payment.

Though HUD’s 245(a) program was designed to assist low-income first-time homebuyers purchase a home sooner than they would be able to with conventional mortgages, it is open to repeat homebuyers as well. They can all take advantage of the FHA’s lenient qualification requirements such as low down payments and credit scores.

Similar to a Graduated Payment Mortgages, this type of home loan is only eligible to purchase single-family properties or condominiums that will serve as the borrower’s primary residence and not an investment property. This loan type is ideal for borrowers who expect to see a rise in their income and want to own a home sooner. However, it is also important that borrowers be completely positive of their future earning potential and job security when deciding to finance their home with a Growing Equity Mortgage.

FHA Loan Articles

July 2, 2023Buying a home is a significant milestone in life, and for many, it's a dream come true. However, the path to homeownership can be fraught with challenges, and one of the most concerning issues can be high FHA loan interest rates.

June 15, 2023When you buy a home with an FHA mortgage, cash for closing costs and your down payment is required. It would be easy to assume you simply give the lender cash in the specified amount and that’s the end of the story.

May 20, 2023Did you know there is an FHA loan option that lets you build a house from the ground up? You can use this mortgage to build on land you own or on land you buy as part of the loan. But you will want to address some issues comparing construction loan options.

May 3, 2023Sometimes when buying a home there may be a question of surplus or excess land. You likely won’t face this issue when buying a condo unit, but for other types of purchases, this may be an important factor in the appraisal process.

April 18, 2023Your lender is required to make sure you can realistically afford your mortgage, and that means verifying that your income is stable, reliable, and will continue after your mortgage has closed. What some don’t realize about this process is that there are standards for verifying income.

March 16, 2023Planning your FHA loan means asking some important questions early in the process. The most obvious question is associated with the type of home you want. How large a house do you need? FHA mortgages allow the purchase of homes with between one and four living units.